嘉盛注册开户

嘉盛外汇平台成立1999年,客户来自超过190国家,拥有超过30种员工语言。我们的管理团队曾到访超过120座全球各地的城市以了解客户和合作伙伴的需求。25+种安全支付方式,10+种交易平台,功能齐全,24/7客服支持

受严格监管的经纪商

嘉盛外汇集团旗下的嘉盛平台分别受澳大利亚ASIC、塞浦路斯CySEC、伯利兹IFSC、迪拜DFSA监管,并严格遵守监管标准。

专注于客户体验

在嘉盛外汇平台,我们不在乎您的资金规模,客户至上是我们的唯一准则,嘉盛外汇集团为所有客户提供高质量的服务,没有任何隐藏条款。客户所见的价格、执行与优惠活动。就是平台真实内容!

多元化交易产品

为了给嘉盛外汇平台客户优质的投资服务,嘉盛平台提供产品包括外汇、贵金属、原油、大宗商品、指数和股票等差价合约。一个平台交易多种商品,嘉盛使交易变得简单。

嘉盛平台

嘉盛致力于提供极具竞争力的交易条件,如低点差、快速执行和无重新报价,从而为交易者创造最佳的交易体验。

嘉盛外汇官网

嘉盛平台以品牌设计为核心,以构建、传播品牌价值为目标的策略型设计公司。我们只专注于嘉盛平台注册登录及代理招商服务,「品质引领发展」是平台的宗旨,「专注成就未来」是追求的目标,共同见证市场的发展与变革,为所有谋求长远发展的企业提供更简单、更安全、更有价值的服务!

嘉盛注册开户

嘉盛外汇集团2009年成立至今,已经拥有超过5000000名客户,嘉盛已经发展为国际知名的投资公司,嘉盛目前雇有600多位在金融领域拥有多年从业经验的专业人士,嘉盛期待与您共创未来美好生活!

嘉盛平台是全球领先的应用服务平台,为全球超过 100 万的企业、开发者及政府机构提供与应用相关的测试、推广、安全、AI 大数据产品优化等解决方案。目前已经完成C轮,超过800万美金融资。嘉盛平台注册A...

联系我们

嘉盛平台官方网站免费提供嘉盛平台注册、登录地址,嘉盛主管专业代理,全天在线,倾其所有让您成为下一个精英。依托互联网技术提供「简单高效\方便快捷」的产品服务,让会员享受快捷、公平、公正的娱乐体验,注册嘉盛让你畅享非凡游戏世界!

外汇新闻

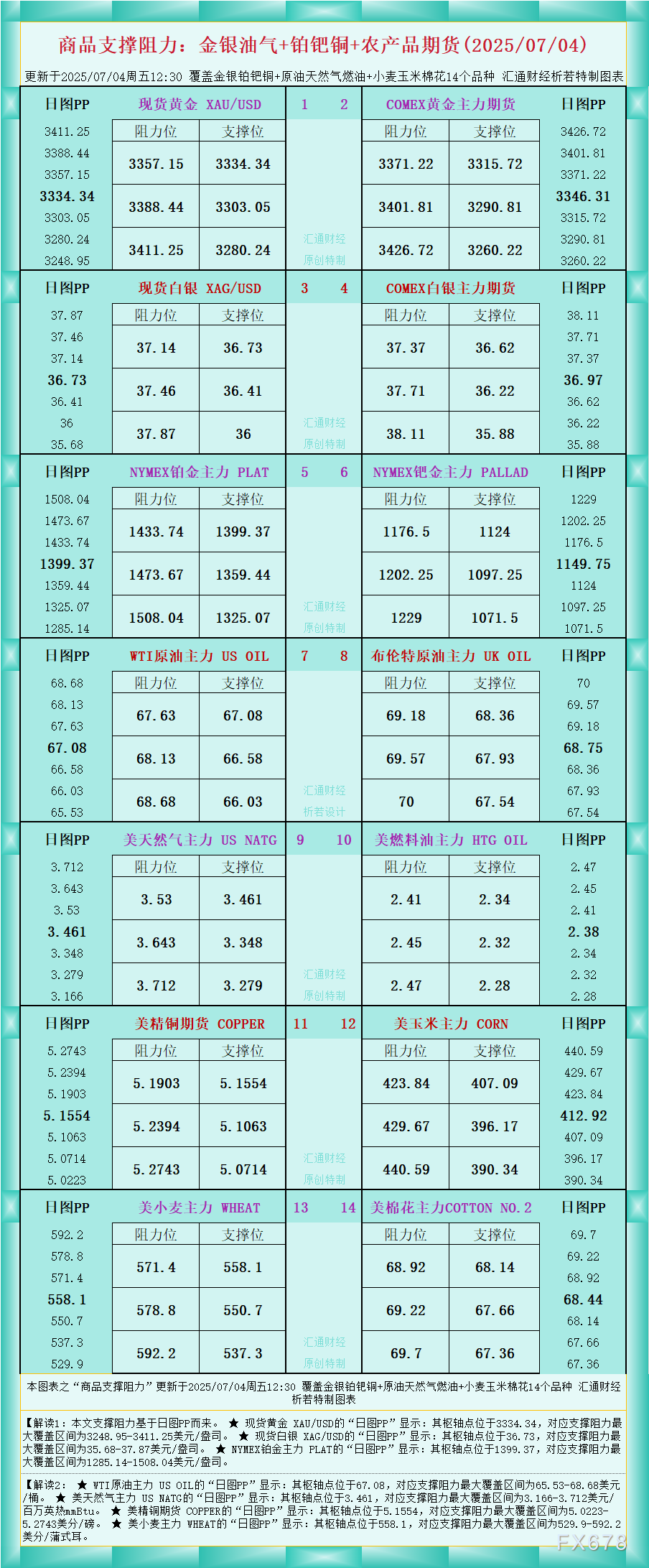

一张图看商品支撑阻力:金银油气+铂钯铜+农产品期货,更新于2025年7月4日周五12:30,具体覆盖金银铂钯铜+原油天然气燃油+小麦玉米棉花14个品种,更多

7月3日,国务院国资委党委书记、主任张玉卓到中国有色矿业集团有限公司调研,强调要深入学习贯彻习近平总书记关于国有企业改革发展和党的建设的重要论述,紧紧围

有记者问:近期,商务部新闻发言人表示,中美就伦敦会谈框架细节达成共识,“中方将依法审批符合条件的管制物项出口许可申请。美方将相应取消对华采取的一系列限制